Business News of Tuesday, 11 March 2025

Source: www.ghanawebbers.com

Current VAT structure does not support dynamics in retail sector – GUTA

The Ghana Union of Traders Association (GUTA) has called for a review of the Value Added Tax (VAT) structure, arguing that it creates financial strain and compliance issues for businesses in the retail and wholesale sectors.

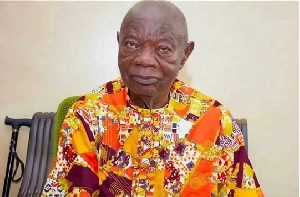

Charles Kusi Appiah Kubi, Head of GUTA’s Business and Economic Bureau, highlighted the disparity between the standard 22% VAT rate and the 4% rate for some goods, which affects competitiveness and forces businesses to lower prices.

Speaking on Channel One TV, he warned that businesses struggling to meet tax obligations risk non-compliance and penalties from the Ghana Revenue Authority (GRA).

GUTA urges a VAT revision to ease business burdens, promote compliance, and support sector growth, emphasizing the need for a fairer and more practical tax system.

Entertainment